Wrapping Your Mind Around Wrap Rate

Learn what a wrap rate is, how to calculate it, and how it can help you put together competitive bids on the right opportunities.

You've likely heard the term “wrap rate” many times in your government contracting career, but do you really understand what a wrap rate is and all the costs it entails?

What Is a Wrap Rate?

Simply put, the wrap rate is the spread (multiplier) between what an employer pays for an employee’s service, and the price that the employer charges the client.

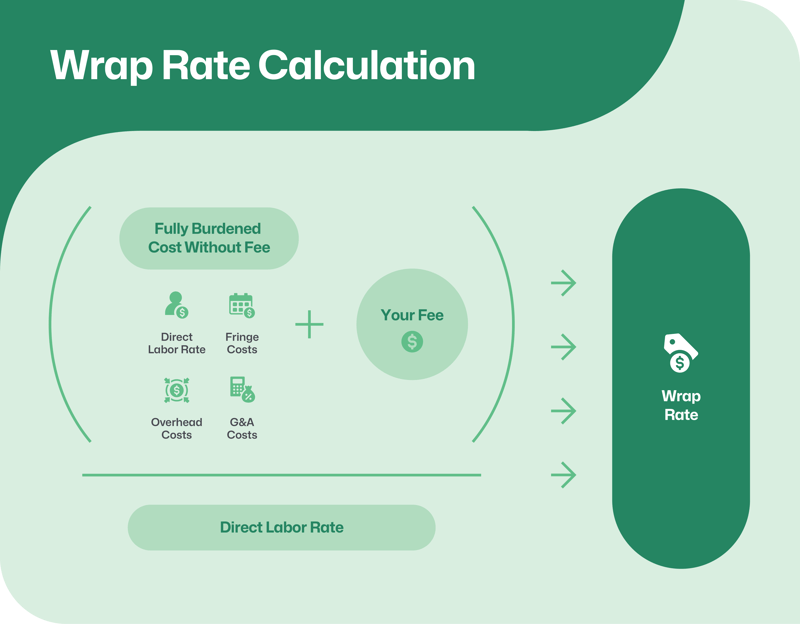

It encompasses hourly labor rates for all costs, including:

- Direct labor

- Fringe benefits

- Overhead costs

- General and administrative (G&A) costs.

Understanding Wrap Rate Costs

There are different wrap rates for cost only and fully loaded with profit.

Some companies have different fringe rates for salaried and hourly employees. Many companies have different overheads for a company site and a customer site. Some also have them by different operating divisions.

All government contractors must watch their wrap rates closely to remain competitive and avoid losing money on projects by not accounting for all costs.

What does that look like from a practical standpoint? Let’s take a look at how to examine key costs.

1. Direct Labor (DL) Costs

For example, Jen gets paid $50 per hour and Jen’s employer charges the customer $100 per hour for her services. Jen’s employer’s effective wrap rate for this particular transaction is 2.0 (100 / 50).

Make sense so far? Great! Now let’s do some more digging into what a wrap rate entails.

2. Fringe Costs

So, while Jen gets paid $50 (less applicable taxes) per hour directly from her employer, there are some additional costs associated with her employment. Some of these fringe costs are mandated by law, like federal payroll taxes such as FICA and FUTA, and state taxes like SUTA.

Other fringe costs are employer choices (insurance, 401K plans, leave, and other benefits) to attract and retain a top-notch workforce.

These indirect costs are called fringe costs. Let’s say this is 36% for this example.

3. Overhead (OH) Costs

There are other costs that are necessary for the employer to pay so Jen can perform the work for the client. For example, Jen will need a computer, software tools, and a smartphone to effectively serve the client, and her employer happily pays for this.

Jen requires training, project management, and supervision to effectively manage her and complete assigned tasks to be successful in the performance of her work.

Jen may need an office (prorated rent and utility costs) for Jen to collaborate alongside her teammates, as well as a conference room and kitchenette to host clients and prospects from time to time. This would be a company-site overhead rate.

Sometimes Jen works at a remote client location and there may be a different overhead assigned. This would be a customer-site overhead rate.

These indirect costs are called overhead (OH) costs. Let’s say this is 28% for this example.

4. General & Administrative (G&A)

There are other costs of doing business, such as sales and marketing, back-office functions, travel expenses, and outsourced services that are necessary to run the business.

These costs are called general and administrative (G&A) costs. Let’s say this is 15% for this example.

5. Your Profit's Impact

Lastly, companies need to make a profit, and all these factors (direct labor, fringe, OH, G&A, and profit) are considered in a wrap rate.

You would need to charge at this rate to breakeven rate and the higher you go, your profit increases. When your customer agrees to your rate, you have a sell rate.

Profit margins will be what the market can bear, and this will vary depending on the customer, competitive environment, contract type, and unique opportunity.

How To Calculate Wrap Rate

DL costs + fringe costs + OH costs + G&A costs is the calculation for the fully burdened cost of Jen’s labor without fee.

- $50 * 1.36 *1.28 *1.15

- $50 + $18 + $19 + $13 = $100 (rounded)

This would be the breakeven wrap rate.

Jen’s employer would need to charge $110 to make a 10% profit.

The employer’s current (sell) wrap rate for the transaction in the example of 2.0 is insufficient to recover all costs and provide a reasonable return. While Jen’s employer may not be able to do anything about the sell rate on that transaction, the wrap rate for pricing future transactions should be at least 2.2.

This is the value of a wrap rate.

While the calculations shown above are not terribly complicated, the wrap rate is an easier, quicker way to go from a raw labor rate to a sell rate you can live with in a single step. The calculation for each company’s wrap rate is highly proprietary and if a company has multiple fringe and/or overhead rates, it may have multiple wrap rates depending on which ones apply to a given individual.

In addition, there may be different methodologies, calculations, and approaches for each of the separate indirect cost pools depending on the composition of the pool base. But this is the most common methodology.

Why Wrap Rate Matters for GovCons

At PTW, we believe that the wrap rate is indicative of a company’s culture and impacts its ability to compete, win contracts, and retain a quality workforce.

Knowing and understanding your company’s wrap rate will be a crucial indicator of whether you are bidding on the right opportunities for your business to maximize your growth.

Consistent application and careful indirect rate management are key to being able to be successful in winning new proposals and price contracts to win with optimal probability and profitability.

About PTW Solutions

PTW Solutions is a management consulting firm that focuses exclusively on the federal market. PTW helps companies plan, position, prepare, propose, and price to win lucrative and resilient federal government contracts. For more information, visit www.pricetowinsolutions.com.