Financial ratios critical for managing your AE firm

Financial statement ratios provide key insights into your AE firm’s financial health. Learn how to use financial ratios to drive growth, improve efficiency, and increase profitability.

.jpg?length=700&name=shutterstock_399042256%20(1).jpg)

Your financial statements hold valuable data that help you understand not just how well your architecture and engineering (AE) firm has performed but also how it might perform in the future. However, financial statements alone hold little value until you know how to conduct a financial statement analysis, evaluate key financial ratios such as the current ratio, profitability ratio, and cash flow ratio, and use that information to improve financial health, efficiency, and growth.

Analyzing your financial statements is essential for managing your AE firm effectively. Financial ratio analysis helps you assess key metrics like the debt ratio, equity ratio, and profitability ratios to gauge financial health. Comparing your firm’s financial performance not only to prior years but also to competitors and industry benchmarks provides deeper insights for strategic decision-making.

The first questions to consider are whether your current internal financial reports provide all the information needed and whether decision-making could improve with better financial data. The balance sheet and income statement are only the starting points for successful financial management. A firm must also understand and utilize detailed financial statement analysis and the reporting tools available within its accounting system to track key financial ratios such as the cash flow ratio, liquidity ratio, and asset turnover ratio.

Financial statement analysis gives your firm a better grasp on its data

So, how can improved financial statement analysis help you? Streamlining your accounting reports can assist in locating and correcting accounting errors, identifying areas for business improvement, and enabling faster responses to financial challenges. It also helps you analyze key financial ratios, such as the receivables turnover ratio and profit margin, to better understand the interrelationship of accounts and develop more effective solutions for identified issues.

Financial statement analysis also helps monitor the success and failures of business initiatives while identifying new business opportunities. By evaluating key financial ratios such as the gross profit margin, net profit margin, and asset turnover ratio, your firm can establish better terms for proposals and contracts and track performance on existing jobs more effectively.

To ensure your financial analysis is effective, your firm must capture all relevant data while also maintaining high data quality. Tasks such as tracking time consistently, preparing account reconciliations, and closing out the accounting ledger on a monthly basis are critical to accurate financial reporting. Key financial ratios, such as the cash flow ratio and liquidity ratio, rely on precise data—reinforcing the adage, “garbage in, garbage out.”

Basic financial statements

In the AE industry, many smaller firms operate strictly on the cash method of accounting because of its ease of use and advantages for income tax reporting. However, it is not appropriate and should not be used for financial reporting. In a professional service firm, the cash method of accounting significantly understates the firm’s net worth and affects key financial ratios such as the profit margin and equity ratio. When income and expenses are not properly matched in the same accounting period, profitability is distorted. Accounting software packages often provide both cash and accrual financial statement reporting options to support accurate financial statement analysis.

The balance sheet represents a snapshot of a firm’s financial position at a specific point in time. Key assets, such as accounts receivable and work in process, play a significant role in financial health and impact liquidity ratios and the receivables turnover ratio. The income statement is a period-to-date summary of revenue and expenses that calculates net income or loss for the period. For a professional service firm, the income statement differs significantly from other entities, as net income may not fully reflect profitability due to discretionary bonuses paid to owners. A properly structured income statement is essential for managing profitability, conducting financial ratio analysis, and making meaningful comparisons with peer firms in the industry.

The income statement

Key elements of a firm’s income statement include gross revenue and net revenue. Gross revenue represents total fees billed to clients, including reimbursable expenses, while net revenue is gross revenue minus reimbursable expenses. Net revenue reflects the earnings from the firm’s labor and serves as a basis for income statement comparisons across prior periods and industry standards.

Direct labor plays a critical role in financial ratio analysis for AE firms and is commonly used in key metrics such as the profitability ratio and operating profit margin. The industry standard percentage of direct labor to net revenue typically falls between 32% and 34%. The contribution margin, which represents net fee revenue minus direct labor and project expenses, helps determine a firm’s ability to cover overhead costs and generate net profit.

A common industry guideline for the gross profit margin is between 66% and 68%. Indirect costs—your firm’s overhead—include expenses such as administrative labor, benefits, insurance, occupancy costs, and office expenses. One of the most significant performance measures of firm profitability is net income before discretionary items, which typically ranges from 10% to 15%.

Ways to improve your basic financial statements

A fairly easy improvement to your monthly financial statements is to include comparisons to prior years. Monthly financial statements should include fluctuations showing both dollar and percentage changes. The income statement should include both current month and year-to-date amounts as a comparison to the prior years. The financials should also include the appropriate level of detail and be reported by division and location.

The income statement should be presented in the appropriate format specific for professional service firms to include separate categories for gross revenue, reimbursable expenses, net revenues, direct labor, direct expenses and overhead.

Improved financial statement analysis

Going beyond the basic financial statement is the next step in analyzing the success, failure, and progress of your business. Fluctuation analysis is a study of changes in amounts from period to period by both dollar change and percentage change. Understanding the relationship among different balances and identifying unusual fluctuations is essential to better understanding your firm’s financial performance.

Utilizing budgets and forecasts are necessary for running an effective business. Detailed budgets can be used to compare variances between actual and planned performance. With a proper budget to analyze, management is able to quickly identify and respond to variances to get operations back on track. Too often, a significant amount of time is spent preparing budgets that are not utilized during the year. Budgets are only useful if they are being used in analysis.

Performing ratio analysis and benchmarking can also provide additional insights into the operations of a firm. Ratios can serve as benchmarks against which the firm can evaluate itself. There are several key financial statement ratios specific to AE firms which are detailed below.

Understanding and utilizing key ratios

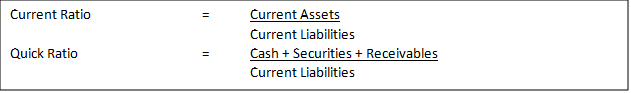

Financial analysts group ratios into categories which tell us about different facets of a firm’s finances and operations.

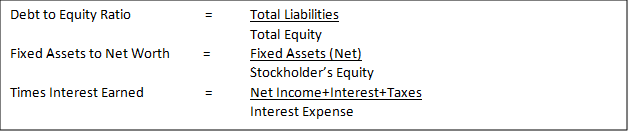

Leverage ratios show the extent of debt that is used in a firm’s capital structure. Solvency ratios give a picture of a firm’s ability to generate cash flow and pay its financial obligations. Formulas for important leverage and solvency ratios include:

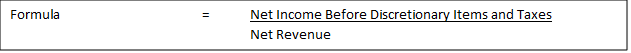

For professional service firms, the most significant measure of economic benefit available to owners is a firm’s net income before discretionary items and taxes. This measure of net income reflects the firm’s operating income available to be distributed to the firm’s owners. The firm’s net income before discretionary items and taxes represents its annual earnings before bonuses and profit-sharing contributions. This ratio provides a strong indication of its true earning capacity. The formula for net income before discretionary items and taxes to net revenues is:

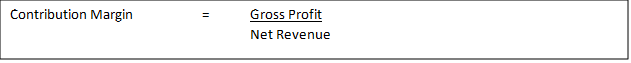

Contribution margin is the firm’s ratio of net revenue after direct labor expended on projects compared to the firm’s revenue. This ratio measures the firm’s contribution to cover overhead (indirect) expenses and to provide for pre-discretionary profitability. The formula for contribution margin is:

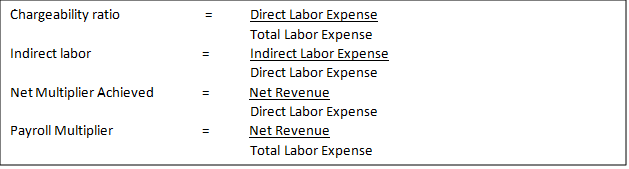

The chargeability ratio demonstrates the percentage of total staff time charged directly to projects and is a great measure of labor efficiency. Smaller firms are typically characterized by higher chargeability while larger firms have additional administrative personnel. Another labor ratio compares the total indirect labor to direct labor to measure the mix of billable vs. non-billable labor costs. The net multiplier achieved provides a relationship of the firm’s net revenue earned as compared to direct project labor expended on contracts in order to measure the effectiveness of the firm’s utilization.

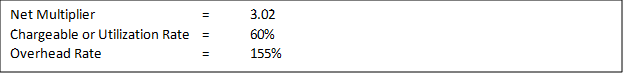

The net multiplier target is typically 3.0 and is used to set fees and prepare budgets. The payroll multiplier represents the ratio of the firm’s net revenue to total labor and measures the net revenue earned by the firm per dollar of total labor expended. Formulas for important labor ratios include:

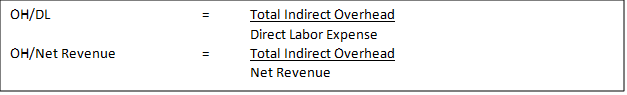

Overhead ratios are also a focus for many firms. An AE firm’s overhead rate is the ratio of all indirect overhead expenses, either before or after discretionary items, compared to the total direct labor on projects.

Another overhead ratio is a comparison to overall net revenue. Formulas for important overhead ratios include:

Interpreting financial ratios and setting targets

A single ratio or fluctuation will not give you enough information to make a judgement about your firm and cannot be interpreted in a vacuum. A ratio merely points out what needs to be investigated and you must have additional data to evaluate.

Firms should use targeted financial ratios as a means to meet their goals for profitability and long-term planning. For example, the firm might target the following income statement ratios:

Industry comparison

Industry comparisons are a great measure of your firm’s performance in relationship to other firms to evaluate your operating efficiency. The AE industry has excellent data available for all size levels of firms and industry comparisons must be a part of the firm’s financial analysis. Sources of industry data include:

- PSMJ Annual Survey & Report on Financial Performance in Design Firms

- Risk Management Association (RMA) industry statistics

- Zweig White & Associates Valuation Survey of A/E Firms.

Compare your firm to the industry average or median data to see how you measure up to your competition.

Analyze and take action

Effective financial analysis is a four-step process to prepare the proper reports, distribute the reports to the proper personnel, perform analysis, and make management decisions based upon the analysis.

Consider how much time is spent by your firm to produce financial data versus the time spent using the data. Make sure your firm takes the time to perform data analysis every month. Financial analysis should also be documented and shared with others within the firm, as it is only effective when followed up upon and action is taken. Recognize that change is needed to achieve improved results, however, be certain to analyze the cost versus benefit of any financial decision.

When it’s done the right way with quality data, financial analysis is a powerful tool that can help you run your firm more effectively and profitability.

Victor W. Vaccaro, Jr., CPA/ABV, CFF, CDA, is the partner-in-charge of assurance services. Vic has over 34 years of experience providing auditing, accounting and consulting services. He specializes in working with manufacturing companies and architectural and engineering firms.

Vic’s areas of expertise include FAR overhead audits, business valuations, ownership transition, mergers and acquisitions and forensic accounting. In addition, he focuses on consulting engagements designed to enhance the profitability of his clients, including implementation of performance management techniques, activity based costing projects, customer profitability analysis, improved budgeting and strategic planning initiatives. Vic is also the partner-in-charge of the firm’s manufacturing practice group.