Excelling at the art of financial management strategies in government contracting

Navigating your financial future is much easier when you understand the challenges ahead - and the tools and technology you'll need to succeed.

Navigating financial challenges can feel overwhelming for many government contractors. The complexities of budgeting, compliance, and competition can create significant pressure. However, implementing the right strategies can transform these obstacles into valuable opportunities for growth and success.

The 2024 GAUGE Report, the annual GovCon industry benchmarking tool written by Unanet and CohnReznick, is a valuable asset for government contractors looking to evaluate their success and how their operations stack up for the future. This year’s report, titled "Balancing Efficiencies & Compliance with AI Insights,” includes some intriguing findings on the state of financial management in government contracting.

Let's take a closer look at how you, as a GovCon, can better manage your finances with a nod towards the research uncovered in the GAUGE - understanding the current landscape, how to manage costs, and what role technological developments like AI might play in financial management going forward.

The major financial challenges in the government contracting industry

Government contractors encounter various financial challenges that can significantly affect their profitability and growth. According to the GAUGE Report, several key issues have been identified as particularly impactful, with several changes in data from 2023 to 2024.

One of the most pressing challenges is finding new revenue sources, with 61% of contractors highlighting this concern in 2023, slightly decreasing to 57% in 2024. In addition, the issue of organic growth is also prominent, affecting 43% of contractors in 2023 and dropping to 37% in the following year.

Uncertainty in federal spending remains an ever-present concern, with 35% of contractors reporting this challenge for both 2023 and 2024. Managing cash flow, particularly through accounts payable and receivable processes, poses another obstacle, with 22% of contractors facing difficulties in 2023, which increased to 29% in 2024.

The pressure to increase EBITDA is felt by 23% of contractors in 2023, rising to 26% in 2024. Lastly, achieving executive alignment is essential, though it remains a challenge for 16% of contractors in both years.

Grasping these financial challenges is key. It sets the stage for creating smart financial management strategies that tackle these issues directly.

Cost management strategies and concepts

Effective cost management is integral to maintaining profitability and cost savings. It involves two key project management focus areas: efficiently using resources and allocating your budget correctly as well as following best practices for managing operational costs:

Efficient use of resources and budget allocation

To ensure project success and drive organizational growth, prioritize spending by focusing on essential expenditures that directly impact outcomes. Implementing efficient management principles can further enhance efficiency by eliminating waste and optimizing processes. Creating a self-audit plan and team with planned audits will help identify inefficiencies and highlight areas where costs can be reduced, ultimately supporting a more streamlined and effective approach to resource management.

Using advanced financial software can also significantly enhance efficiency. Automating key processes such as invoicing, accounting, expense tracking, and reporting can help reduce manual errors and save time. These tools provide real-time insights into spending patterns, enabling better decision-making and more agile financial management.

Best practices for managing operational costs

First, automating processes through financial systems can significantly decrease manual labor, streamlining workflows. Engaging in vendor negotiations allows companies to secure better terms with suppliers, ultimately lowering procurement costs. Finally, focusing on energy efficiency by adopting energy-saving measures can lead to substantial savings on utility expenses. Integrating these approaches can contribute to a more efficient and cost-effective government contracting operation.

Pay attention to wrap rates

Wrap rates are essential for evaluating a company's efficiency, as they include costs like direct labor, benefits, overhead, and administration. Recently, many companies have seen a drop in wrap rates as they strive to reduce indirect costs and improve profitability. To remain competitive, regular reviews and optimizations of these structures are helpful.

Wrap rates provide insights into a company's overall cost structure and can impact pricing strategies, competitiveness, and profit margins. Keeping an eye on wrap rates can help businesses ensure they’re operating effectively and staying ahead in a challenging market.

Indirect rate structures

According to findings from the GAUGE, changes to rate structures are starting to slow down as we get back to a pre-pandemic normal. For the first time in five years, we’re seeing a significant drop in the number of government contracting companies reporting changes to their indirect rate structures over the past year. About 15% of businesses say they haven’t changed their indirect rates at all, which is an increase from last year’s record low. As the pandemic’s impact continues to lessen, fewer companies feel the need to tweak their indirect rates.

Stability in rate structures can lead to more predictable budgeting and financial planning. When companies aren’t constantly adjusting their rates, it allows for better long-term forecasting, financial reporting, and resource allocation. This leads to healthier financial management practices.

AI in financial management

Artificial intelligence (AI) has come a long way in a few short years. While marketing and business development are areas in which many government contracting companies are turning to AI, fewer GovCons are looking to AI for finance and accounting needs.

While the fear of embracing AI is holding some back, this presents an opportunity for forward-thinking government contracting agencies. Here's how AI can make financial operations, forecasting, cash flow management and planning even better:

- Real-time cash flow monitoring: AI provides instant insights into cash flow, helping businesses make informed decisions.

- Predictive forecasting: AI analyzes trends to forecast future financial performance.

- Automation of accounting processes for accounts receivable and accounts payable (AR/AP) : Send and receive money faster while reducing manual errors. Using financial management with automated AR/AP processes such as Unanet can help save so much time and money.

- Anomaly detection: The ability to automatically flag errors in accounting ensures more accurate financial data and enhances overall profitability.

Despite these benefits, many government contracting firms are hesitant to adopt AI due to immature finance practices, lack of expertise, and budget constraints. Overcoming these barriers requires a strategic financial strategy and investment in training.

Managing financial risks

Many government contracting agencies see AI as a risky proposition, but the truth is every government contractor will have to employ some amount of risk management when it comes to managing their finances whether they embrace AI or not.

Identifying and mitigating financial risks is how you maintain sustainable financial health. Here are some high-level strategies for how to do just that while promoting financial stability:

- Diversify revenue streams: Relying on a single revenue source can be risky. Diversifying can provide a buffer against market fluctuations.

- Maintain healthy cash reserves: Having a reserve can help manage unexpected expenses or delays in payment.

- Regular risk assessments: Conducting regular risk assessments helps identify potential threats and develop mitigation plans.

Managing these risks is easier when you have the right systems in place to support your finance department.

Elevate your financial management

Effective financial management has to be a cornerstone for all government contractors aiming to thrive in a competitive environment. By understanding their financial challenges, optimizing cost management strategies with the usage of solutions like Unanet, leveraging AI, and managing financial risks, contractors can achieve greater efficiency and profitability.

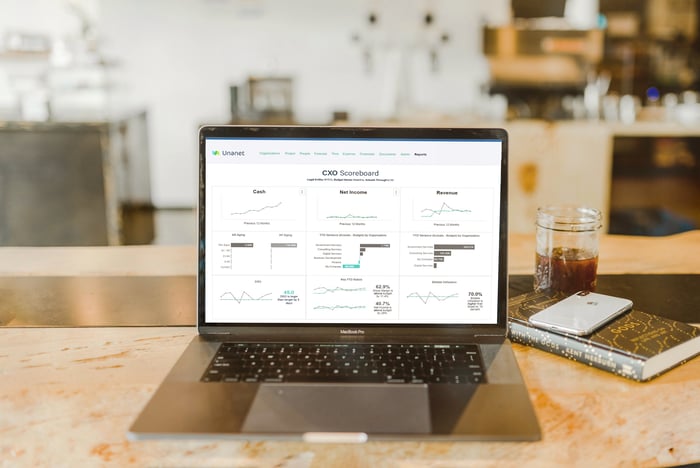

Of course, you can’t optimize your finances – your data, processes, and business outcomes – without having the right tools in place. With Unanet, you can simplify financial management in a way that can help you cut costs and boost productivity across your organization.

Looking to make business easy while freeing up more time to do the work that matters? Learn how Unanet can help. Schedule a demo today.