Profitability is a good sign, but it’s not sustainable if the profits are stuck in accounts receivable (AR). There are two important metrics you can use to evaluate cash flow:

- Days sales outstanding (DSO): the number of days between making a sale and collecting payment – calculated for the year by dividing AR by Annual Sales and multiplying by 365.

- Invoice cycle in days: the number of days between the beginning of the billing process and customer acceptance.

Keeping these numbers as low as possible ensures that your company can put cash to use more quickly.

Days Sales Outstanding (DSO)

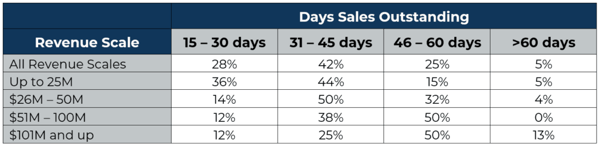

In the 2019 GAUGE Report, 70% of respondents reported DSO below 45. Contractors are focused on reducing DSO, which has improved from last year in the <46-day categories for companies of all revenue scales.

Breaking it down by revenue scale, companies with higher revenues tend to have higher DSO. Among those with revenue up to $25M, 80% have DSO below 45, compared to just 37% of companies with revenue above $101M.

Compare your DSO to others in your revenue band. Are you better or worse than the respondents?

Invoice Cycles

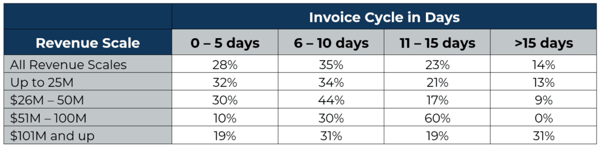

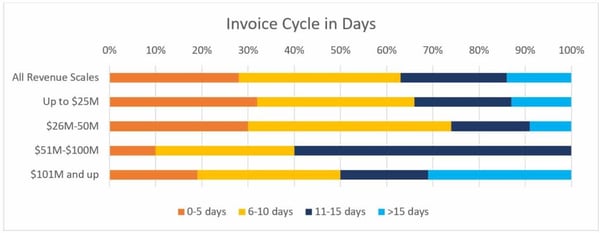

Since last year, invoice cycles are 12% better in the <11-day categories, which signals a concentration on process and tool selection. The faster you can invoice, the faster you can turn your cash. Errors in the invoice cycle can slow down the process and keep you from being paid. As government contractors, you will need to make sure you are current on the regulations and have all your I’s dotted and T’s crossed.

Breaking it down again by revenue scale, we see trends similar to DSO. The speed of invoice cycles for companies with up to $25M of annual revenue surpassed the other revenue scales in the survey.

Compare your invoice cycle to others in your revenue band. Are you better or worse than the respondents?

Characteristics of an ERP with Cash Acceleration in Mind

Cash is king for government contractors! As a GovCon, it is critical to be able to automate and shorten the bid-to-bill lifecycle and to keep revenue recognition and billing completely in lock step. When looking for a tool, it is important to have:

- A time application that is part of the project-based ERP system so that billing can be done quickly Traceability of all transactions

- Multiple, standard invoice formats to be used across projects, showing summary or detailed level information

- Ability to hide or show cost element detail on Cost Plus invoices

- Ability to include Fixed Price, Time & Materials, Pre-Bill Labor, and Additional Items on the same invoice

- Ability to defer items from the current invoice for future invoicing

- Ability to add one-time items such as additional fees or discounts

After switching to Unanet, Phase One Consulting Group completes all month-close procedures in 5 to 7 days, reduced their invoicing process from 20 to 7 days, and improved DSO from 60 to 50.

To learn more about cash acceleration for your government contracting organization, read Unanet and CohnReznick’s 2019 GAUGE Report. The GAUGE Report is a valuable benchmarking tool for GovCons who seek deep insights into industry practices and metrics. Download your copy today!