DCAA compliance: Key insights into DCAA compliance requirements

Learn about DCAA compliance and DCAA compliance requirements for government contractors. Understand federal cost accounting regulations & stay audit-ready.

Who or what is DCAA?

DCAA compliance, which stands for Defense Contract Audit Agency compliance, is essential for any contractor working with the Department of Defense (DOD) or other federal agencies.

The DCAA’s mission is to deliver audit and financial advisory services to ensure effective acquisition and contract administration. In essence, DCAA compliance requirements are designed to guarantee that the DOD receives the best value for every dollar spent on defense contracting, as outlined on their official website.

A brief history of DCAA

DCAA was formed in January 1965 under the direction of the Under Secretary of Defense (Comptroller). The agency was created in response to a study initiated by Secretary of Defense Robert S. McNamara. William B. Petty, former Deputy Comptroller of the U.S. Air Force, became the first director of DCAA.

Prior to the formation of the DCAA, the various branches of the military handled their own contract audits, but there was a lack of consistency in administration and auditing. Joint audits began with the Navy and Army Air Corps in 1939, and the Armed Services Procurement Regulation (ASPR) unified acquisition regulations in 1947. However, a single contract audit manual wasn’t issued until 1952.

Once DCAA was established, it assumed responsibility for maintaining the contract audit manual. Today, the Defense Contract Audit Manual (DCAM) is regarded as the authoritative source for detailed processes and procedures in government contract audits, covering both DOD contracts and those awarded by civilian agencies. DCAA compliance ensures that audits are consistent and effective, meeting all necessary DCAA compliance requirements.

If DCAA is an audit agency, what is “DCAA Compliance?”

DCAA compliance is shorthand for adhering to all the cost accounting regulations set by the federal government. Since DCAA is by far the largest player in government contract auditing, the term "DCAA compliance" has become synonymous with federal contract cost accounting compliance.

While not entirely accurate, it's a convenient way to reference the necessary compliance standards for federal contracts.

The two rules of cost accounting compliance

.png?width=1200&height=502&name=DCAA%20Blog%20Graphics_Two%20Sets%20of%20Rules%20v3%20(1).png)

For government contractors, staying compliant with federal cost regulations is essential, not just for winning work, but for keeping it. Two key frameworks govern how costs must be handled on federal contracts: the FAR Cost Principles and the Cost Accounting Standards (CAS). Each plays a distinct role in ensuring accuracy, consistency, and fairness in how costs are reported and billed to the government.

The first framework, applicable to most contractors, is the Cost Principles outlined in Part 31 of the FAR. These principles provide detailed guidance on the treatment of costs, ranging from labor and payroll expenses to bid and proposal costs. Part 31 also includes extensive rules about which costs are considered "allowable" and can be passed on to the government, either as direct charges to a contract or in the contractor's indirect rates, and which costs are "unallowable" and cannot be passed on at all.

The second set of rules is the CAS. While the FAR cost principles focus primarily on allowability, the CAS is concerned mainly with allocability—how costs must be measured and allocated to ensure compliance with federal contract requirements.

What it means to be "DCAA compliant"

.png?width=853&height=472&name=DCAA%20Blog%20Graphics_DCAA%20Compliant%20v1%20(1).png)

"DCAA compliance" carries another important connotation. In a DCAA audit report, the agency expresses opinions on the allowability of costs (FAR), the allocability of costs (CAS), and the reasonableness of costs or "quantum" in accounting terms.

A company is considered "DCAA compliant" when:

-

- Their policies correctly address the cost accounting treatment of costs,

- Their procedures outline the appropriate steps to handle costs properly, and

- Their actual cost accounting practices align with their policies and procedures, ensuring full DCAA compliance.

The “who” and the “what” of DCAA auditing

DCAA, as its name suggests, audits government contracts to ensure adherence with DCAA compliance requirements. They also audit contractors, but only in connection with contracts that are subject to audit. For example, DCAA would not audit a contractor that supplies goods exclusively on competitively awarded firm fixed-price contracts. However, if those same contracts were cost reimbursable, the contractor would almost certainly be subject to audit as part of DCAA compliance.

The contracts and contractors DCAA audits are primarily those awarded by the DOD. However, DCAA also handles a significant portion of audits for government contracts awarded by civilian agencies such as NASA, DOE, EPA, DHS, and the VA. In these cases, DCAA is reimbursed by those agencies for audit services.

Other agencies have historically contracted with commercial audit firms, such as CPA firms, to fulfill their audit needs. Ensuring DCAA compliance is critical for contractors involved in government projects, as it guarantees adherence to the necessary cost accounting and regulatory standards.

All audits performed by DCAA, whether on behalf of the DOD or a civilian agency, are governed by a written audit program designed to ensure full DCAA compliance.

This program specifies every step of the audit process in great detail, from contractor notification and the entrance conference to the formulation of the report, its findings, and its distribution. DCAA’s audit programs are also utilized by civilian agencies as part of their statements of work when contracting commercial firms for audits.

All DCAA audit programs, along with internal guidance for agency auditors, are made publicly available on the DCAA website.

Contractors should visit the Directory of Audit Programs as their first step upon receiving notification that DCAA will be auditing their operations or a government contract.

If the audit type is unfamiliar, contractors should inquire about which specific audit program will be performed before scheduling an entrance conference or auditor visit. The audit program will outline the steps of the audit, as well as the data and reports that may be requested, helping contractors meet DCAA compliance requirements.

Forewarned is forearmed. Knowing exactly what DCAA will likely request before they ask can be incredibly valuable.

It’s important to note that DCAA does not audit the Department of Defense itself. DOD has its own internal audit agency, as do other uniformed services and most DOD agencies, such as the Defense Intelligence Agency. Additionally, DCAA does not handle compliance with labor laws like the Service Contract Act (SCA) in connection with Defense contracts. The Department of Labor is responsible for that, even for DOD contracts.

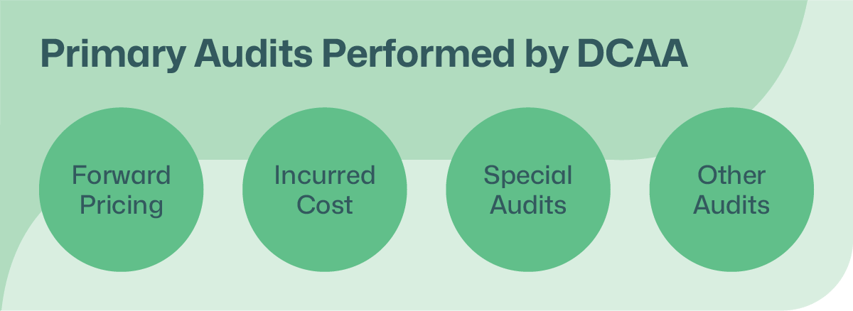

The primary audits performed by DCAA

DCAA must report all activities for the previous Government Fiscal Year (GFY) to Congress by March 31st each year. In the 2019 report, published on March 31st, 2020, DCAA outlined the four basic types of audits they perform, each designed to meet specific DCAA compliance requirements.

1. Forward Pricing

Forward pricing audits are typically completed before a contract award, where DCAA evaluates a contractor's estimate of proposed costs to provide goods or services to the government, ensuring DCAA compliance. These forward pricing audits include demand work such as proposal audits, forward pricing rates, and estimating system audits, all critical components in meeting DCAA compliance requirements.

2. Incurred Cost:

Incurred cost audits assess the accuracy of a contractor’s annual allowable cost representations, ensuring compliance with DCAA standards. Based on the findings of these audits, DCAA expresses an opinion on whether the costs are allowable, reasonable, and allocable to the contracts performed that year, in accordance with government accounting and acquisition provisions. These audits are essential for meeting DCAA compliance requirements.

Learn more about the Incurred Cost Submission (ICS) audit and the documentation required to meet DCAA compliance.

3. Special Audits

Special audits are typically conducted after a contract award to ensure ongoing DCAA compliance.

Most reports in this category are issued in response to requests from contracting officers. Special audits are primarily focused on costs related to claims and terminations, helping to verify that these costs meet DCAA compliance requirements.

4. Other Audits

Other audits can be requested by a contracting officer or initiated by DCAA to ensure DCAA compliance.

These audits focus on the adequacy of the contractor’s CAS Disclosure Statement, compliance with cost accounting standards, review of contractor business systems, or compliance with the Truth in Negotiations Act (TINA), all of which are essential for meeting DCAA compliance requirements

If an audit is in my future, DCAA or otherwise, what should I look for in an accounting system to help maintain DCAA compliance?

DCAA compliance requires that your accounting and related business processes, including policies, manual procedures, and tools, be fully compliant. Software alone is not audited or certified for DCAA compliance, nor is it approved as DCAA compliant.

However, Unanet software has been reviewed by DCAA auditors at over 2,400 customer sites and has been approved as supporting DCAA compliance requirements.

DCAA compliance should be an ongoing result and a state of readiness, not a one-time project.

Unanet is a well-designed system with features specifically created to enforce GovCon rules and automate GovCon-specific processes. This includes the calculation and application of indirect rates, project-based billing, and reporting — all of which help ensure DCAA compliance.

Unanet is purpose-built in-house by GovCon professionals and is the only native integrated Cloud ERP solution designed from the ground up to serve the unique needs of this market. Our solution helps you achieve DCAA compliance and audit confidence with features that support DCAA requirements at every stage.

Ready to get started? See what Unanet can do to help your organization meet DCAA compliance requirements.

Posting revenue by type of contract saves time so that financial periods can be closed quickly and efficiently. We know that everything is closed on time and correctly. Unanet shone during our DCAA audit.