CAS Compliance: What You Need to Know

Learn about CAS compliance and what you need to know about one of the primary sets of “rules” for how GovCons are required to do their cost accounting.

Updated April 2024

Navigating the labyrinth of CAS government contracting isn't just about knowing the terms; it's about understanding the rules that shape them.

Before we delve deeper into the world of CAS compliance, let's clarify what CAS actually stands for and why it's a cornerstone in the rulebook of cost accounting for government contractors.

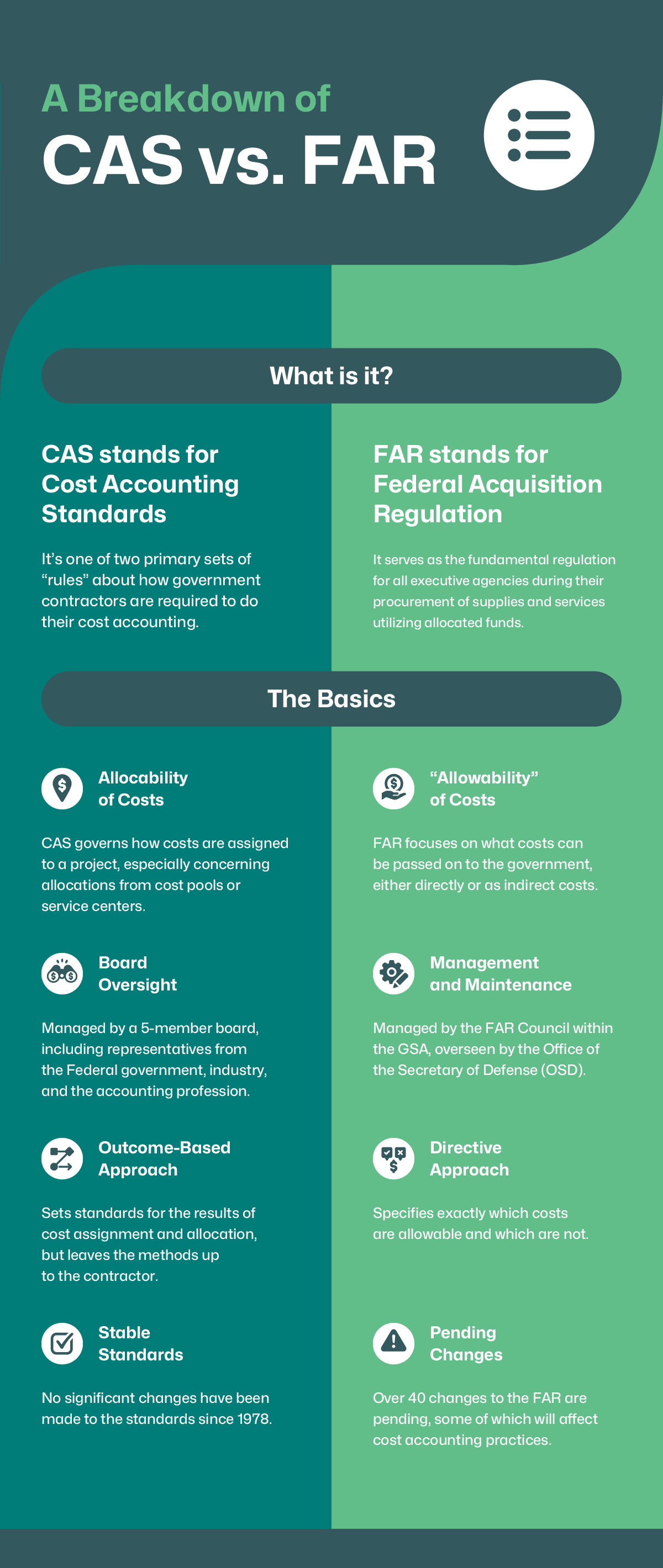

CAS is an acronym that stands for Cost Accounting Standards. It’s one of two primary sets of “rules” about how government contractors are required to do their cost accounting. The other is the Federal Acquisition Regulation (FAR) Cost Principles, contained in Part 31 of the FAR.

What is CAS compliance?

CAS compliance refers to adherence to the Cost Accounting Standards (CAS), a set of 19 specific guidelines (numbered CAS 401 to CAS 420) that govern how government contractors must handle their cost accounting. There is a missing standard (419) that was proposed, but never issued.

These rules are essential for ensuring consistency, accuracy, and transparency when reporting costs in federal contracts.

Compliance is mandatory for contractors that fall under certain thresholds defined by the government and is scrutinized during audits. Failure to comply can result in financial penalties and lost contract opportunities.

Each of the 19 standards addresses the cost accounting treatment of a separate type of cost or practice. The standards are:

- CAS 401 – Consistency in Estimating, Accumulating, and Reporting Costs

- CAS 402 – Consistency in Allocating Costs Incurred for the Same Purpose

- CAS 403 – Allocation of Home Office Expenses to Segments

- CAS 404 – Capitalization of Tangible Assets

- CAS 405 – Accounting for Unallowable Costs

- CAS 406 – Cost Accounting Period

- CAS 407 – Use of Standard Costs for Direct Material and Direct Labor

- CAS 408 – Accounting for Compensated Personal Absence

- CAS 409 – Depreciation of Tangible Capital Assets

- CAS 410 – Allocation of Business Unit G&A Expenses to Final Cost Objectives

- CAS 411 – Accounting for Acquisition Costs of Material

- CAS 412 – Composition and Measurement of Pension Cost

- CAS 413 – Adjustment and Allocation of Pension Cost

- CAS 414 – Cost of Money as an Element of the Cost of Facilities Capital

- CAS 415 – Accounting for the Cost of Deferred Compensation

- CAS 416 – Accounting for Insurance Costs.

- CAS 417 – Cost of Money as an Element of the Cost of Capital Assets Under Construction

- CAS 418 – Allocation of Direct and Indirect Costs

- CAS 419 – [Reserved]

- CAS 420 – Accounting for IR&D Costs and B&P Costs

The purpose of the Cost Accounting Standards is to promote consistency and uniformity in the outcomes of federal contractors’ cost accounting systems, especially in the following areas:

- How costs should be allocated or assigned

- How certain kinds of costs should be measured

- Requirements for covered contractors to comply with the standards

- Requirements for covered contractors to adjust contract prices when there is a change to a cost accounting practice

- Requirements for covered contractors to formally disclose their practices to the government in a prescribed form and format

CAS compliance requirements

A contractor is said to be “CAS Compliant” if the results of its cost allocation practices meet all of the standards.

Like compliance with the FAR cost principles, CAS compliance is not dependent on tools or software. It is measured strictly by looking at the results achieved by a contractor’s policies, procedures and actual accounting practices.

Here are some key compliance elements to keep in mind:

- Applicability: CAS compliance is generally required for contractors with federal contracts exceeding a specific financial threshold.

- Disclosure Statement: Contractors must often submit a formal CAS Disclosure Statement, detailing their cost accounting practices.

- Consistency: Once a particular accounting method is chosen, it must be consistently applied in subsequent contracts.

- Cost Allocation: Costs must be allocated to contracts in a way that is equitable and in line with industry standards.

- Adjustments: Any cost adjustments based on changes in accounting practices must be negotiated and approved by the federal government.

- Documentation: Adequate records must be maintained to prove compliance during audits.

- Subcontractor Compliance: The prime contractor is often responsible for ensuring that any subcontractors are also CAS-compliant.

Failure to meet these CAS compliance requirements can result in severe consequences, including compliance costs and penalties, and the potential loss of future contract opportunities.

How is CAS different from FAR?

The Federal Acquisition Regulations (FAR) and Cost Accounting Standards (CAS) are very different, so it’s important to know the differences between the two.

First, FAR is concerned primarily with the “allowability” of costs in a GovCon’s books. It specifies whether or not you can pass those costs on to the government in your contract costs, either directly or as indirect costs. The FAR is managed and maintained by an organization within the General Services Administration (GSA), the FAR Council. The Council itself is administered by the Office of the Secretary of Defense (OSD) and that office publishes a list of all pending or proposed changes to the FAR.

CAS is all about the “allocability” of costs. The standards govern how a GovCon firm may assign costs to a project, or “final cost objective” in accountant-speak, especially concerning allocations from cost pools or service centers.

The standards are promulgated and amended, from time to time, by a Board authorized by statute (41 U.S.C. 1501 et seq.) and consisting of five members;

- The Administrator for Federal Procurement Policy, who chairs the Board

- Four members with experience in Government contract cost accounting;

- Two from the Federal government (DOD and GSA)

- One from industry

- And one from the accounting profession

The DOD representative is currently the Director of DCAA. The full text of the standards is codified in law at 48 CFR § 52.230-2 – Cost Accounting Standards. An excellent reference to the standards may be found at the Legal Information Institute of Cornell University.

FAR and CAS also differ rather significantly in their approach. FAR is directive – it specifies exactly which costs may be passed on to the government and which costs may not.

CAS is outcome-based. It sets standards for the required results of a contractor’s assignment and allocation practices, but it does not specify how the practices must be performed. The practices are up to the contractor and may be anything desired so long as the results meet the standards.

There is one more rather significant practical difference. There are more than 40 changes to the FAR pending which could reasonably be expected to be issued in the next year or so and four of those will have some impact on cost accounting practices. The CAS Board, on the other hand, has not issued a new standard nor made any significant change to existing standards since 1978.

Who audits CAS compliance?

Like compliance with the FAR cost principles, compliance with the CAS is audited by DCAA for DOD contractors and a number of other agencies which use DCAA for their auditing (such as NASA and DOE). Other civilian agencies will sometimes use a CPA firm to audit CAS compliance when required.

CAS audits are usually triggered by the initial submission of a contractor’s CAS Disclosure Statement when they first become covered. When a contractor becomes CAS covered is another topic all its own.

If CAS is in my future, what should I look for in a cost accounting system?

In a CAS-compliant accounting system, you need automation for processes like indirect rate calculations, application of indirect costs to direct costs, and internal controls. You also need a chart of accounts with enough flexibility to properly segregate direct and indirect costs and to segregate allowable and unallowable costs.

In short, you need a project-based ERP that is purpose-built for the needs of government contractors and their unique cost accounting processes.

Purpose-built in-house by GovCon professionals, Unanet is the only native integrated Cloud ERP solution built from the ground up to serve this unique market. CAS compliance and audit confidence are foundational, not simply a goal to achieve—Unanet features support DCAA requirements at each stage.

Posting revenue by type of contract saves time so that financial periods can be closed quickly and efficiently. We know that everything is closed on time and correctly. Unanet shone during our DCAA audit.

Interested in diving deeper? The seventh annual 2023 GAUGE Report is your go-to resource for the latest best practices and industry trends in the GovCon space. This year's focus is on the transformative power of better forecasting for your business. Arm yourself with valuable insights and practical steps to elevate your competitive stance in the rapidly evolving CAS government contracting landscape.